Cisco Systems Inc. (CSCO)

4 Kasım 2020

4 Kasım 2020

Cisco Systems Inc. designs manufactures and sells Internet Protocol (IP) based networking and other products related to the communications and information technology industry including routers, switches, and servers.

| Key Statistics | ||||||

| 52-Week Range | Avg. Daily Vol (3 Mo) | Market Value | Dividend Yield | Target Price | Consensus Rating (5 strong buy – 1 strong sell) |

Next Earnings Announcement |

| 72.67 – 128.57 | 2,039,705 | 26,810.8 | – | 47.83 | 4.18 | 29/01/2021 |

Additionally, it provides services associated with these products and their use across transporting data, voice and video. CSCO has dominated the market for networking equipment, with an estimated 85% of internet traffic traveling through their systems. In addition to network gear, CSCO also makes security devices and conferencing systems with an increasing focus on software that controls these devices.

CSCO operates four segments, infrastructure, applications, security and other, and services. The infrastructure platform is the sale of core networking technology such as switching, routing, data centre and wireless products. Applications being software-related offerings that run on the networking and data centre platforms. Security and other focus on threat detection, security, cloud, identity and access management and threat management products. Finally services focus on providing technical consulting and support services. Sales of product accounted for 73% of revenue in 2020 with services totaling 27%. Geographically the Americans is the largest market, accounting for 59% on sales in 2020 followed by Europe, Middle East and Africa 26% and Asia Pacific, Japan and China 15%.

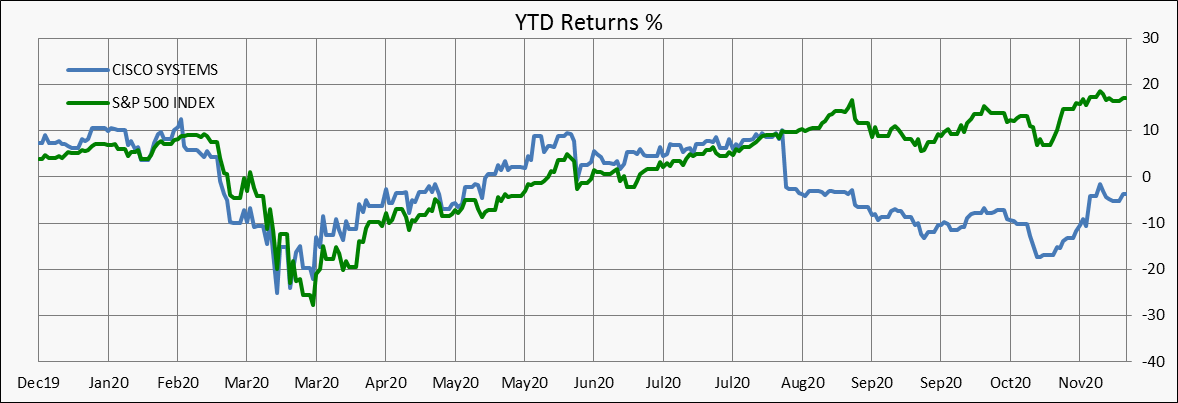

The COVID-19 pandemic has expedited the digital transformation of corporate networks, with CSCO’s upgraded switching and routing portfolio well position for longer-term demand for next-generation networks which could help drive revenue when spending resumes post-pandemic. CSCO is also investing to enable increased automation and support customers for multi-cloud environments, 5G and WiFi-6, faster speeds, optical networking, next-generation silicon, and artificial intelligence. While CSCO may be cautious on its outlook given softer spending on campus networks which holds a 50% market share, CSCO should participate well in the recovery. With the broader acceptance of flexible working remotely Cisco should also benefit from Wi-Fi and security products.

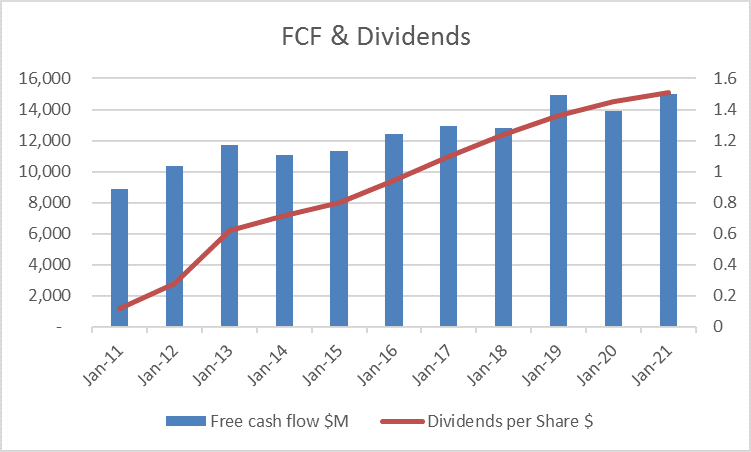

CSCO has a robust balance sheet and healthy cash generation that will allow it to continue buybacks and dividend payments despite the COVID-19 pandemic. The company has guided returning ~50% of free cash flow via dividends or share buybacks and paying down debt, although buybacks will be at a lower rate than in 2019.

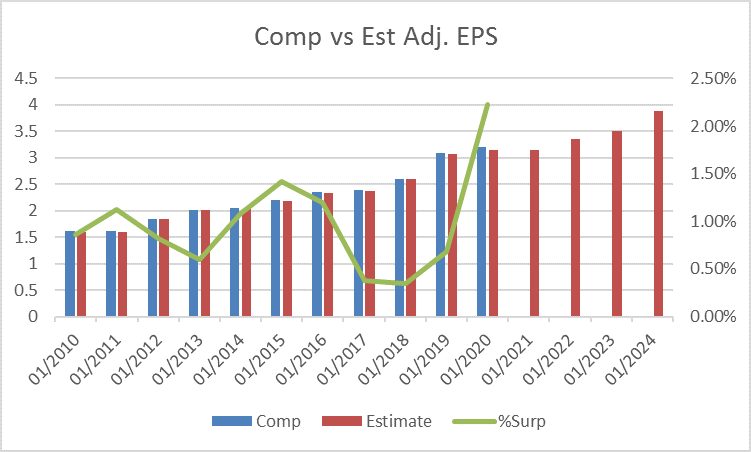

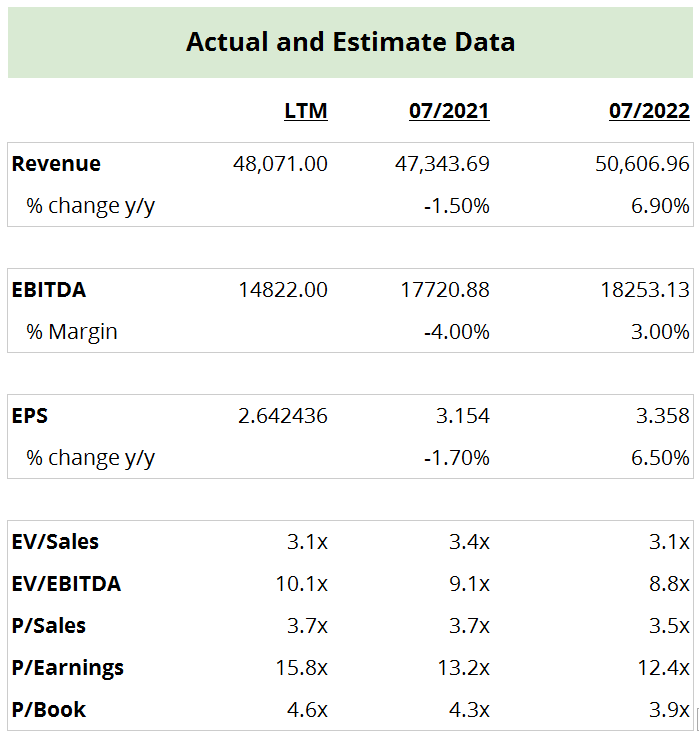

For the financial year ending July 2021 revenue is expected to decline modestly -1.5% to $47,343m before rising +6.9% to $50,606m. Adjusted earnings per share should follow suit, down -1.7% in 2021 to $3.15 before increasing +6.5% in 2022 to $3.36. The stock trades on forward P/E multiples of 12.9 and 12.2 respectively, compared to an average of peers 13.1 and 11.4 respectively.

The average target price of analysts covering the stock is $48.33 with 45% of analysts rating the stock as a buy, compared to 7% as a sell and 48% as a hold.

We are glad you liked it

For your convenience, this will appear under your Saved articles in the top menu.