Philip Morris International Inc. (PM:US)

17 Kasım 2020

17 Kasım 2020

Philip Morris International Inc. (PM) is a holding company that operates through its subsidiaries to license, produce, sell, distribute and market a range of cigarettes, tobacco products, and smokeless nicotine products outside the United States.

| Key Statistics | |||||||

| 52-Week Range | Avg. Daily Vol (3 Mo) | Market Value | Dividend Yield | Float % |

Target Price | Consensus Rating (5 strong buy – 1 strong sell) |

Next Earnings Announcement |

| 54.27 – 85.83 | 4,567,976 | 121,501.8 | 6,2% | 99,8% | 90,94 | 4.44 | 05/02/2021 |

Prior to March 2008 PM was an operating company of Altria Inc. (MO), when it was spun off to focus on sales growth outside the U.S. while Altria Inc. focused on U.S. sales through its subsidiary, Philip Morris USA. In recent years PM has begun the transformation of its business to focus on smokeless products, such as e-vapor and heated tobacco, targeting at least 30% of PM’s consumers to switch to smoke-less products by 2025.

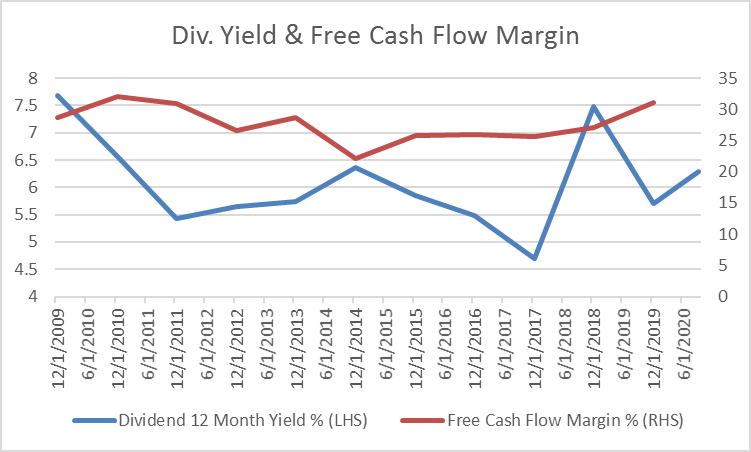

PM operates in six segments across geographical regions, the European Union accounting for 33% of revenue, East Asia & Australia 18% of sales, South & Southeast Asia 17% of sales, Middle East & Africa 14%, Eastern Europe 11% and Latin American & Canada 7%. PM’s shift to non-combustible products is a far more sustainable long-term business model compared with combustible tobacco products. Referred to a “reduced-risk products” by PM, these products accounted for 23% of net revenue from 2020 to September 30 compared with 18.3% over the same period a year earlier. Importantly the reduced-risk products have higher margins, boosting gross margin that should continue in the future assuming regulators continue to tax these products more favorably than cigarettes. PM also maintains a position as the world’s second-largest cigarette producer with about 14% of global volume which affords the company manufacturing scale and pricing power over rivals. This has allowed the company to continue with a high dividend payout ratio, averaging 90% per quarter over the past five years, due to its steady cash flow.

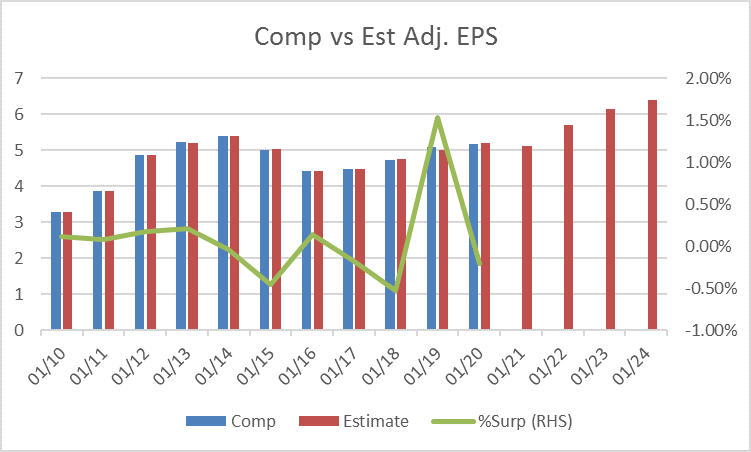

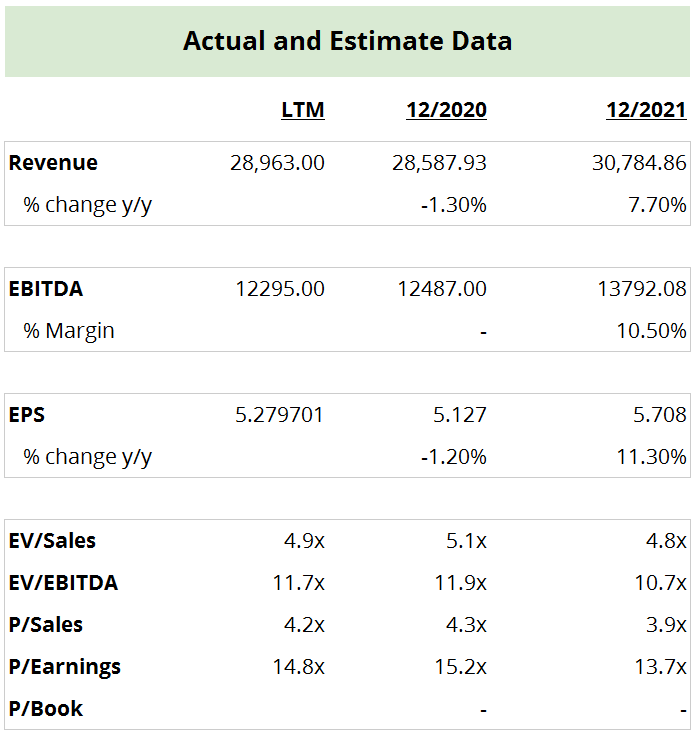

For the financial year ending December 2020 revenue is forecast to decline modestly by -4.1% to US$28,587.9 as higher prices are more than offset by COVID-19 impacts before rising +7.7% in 2021 to US$30,784.9. Adjusted earnings per share is also expected to decline modestly by -2.5% to US$5.13 before rising +11.3% to US$5.71. Based on the adjusted EPS the stock trades on forwarding P/E multiples of 15.2 and 13.7 respectively, a 19% and 17% premium to the average of peers 12.8 and 11.7.

The average target price of analysts covering the stock is $90.94 with 78% of analysts rating the stock as a buy, compared to 0% as a sell and 22% as a hold.

We are glad you liked it

For your convenience, this will appear under your Saved articles in the top menu.